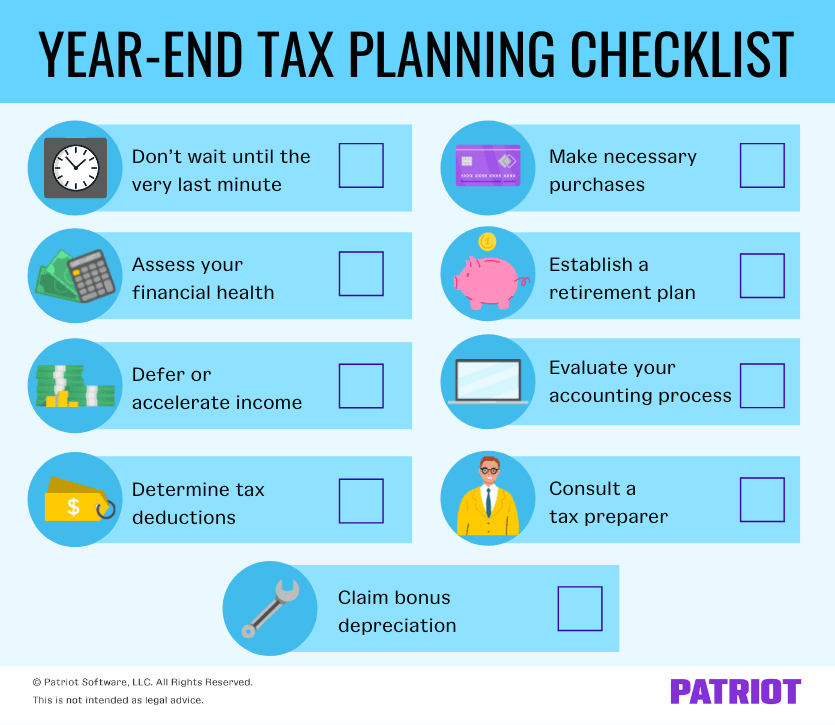

year end tax planning checklist 2021

Revisiting tax planning is an effective tip for your year-end financial planning checklist. Download free checklist now.

Tax Preparation Checklist 2021 Pdf Fill Online Printable Fillable Blank Pdffiller

Since money in an HSA account remains yours and contributions reduce taxable income.

. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. 2021 Year-End Planning Checklist The end of the year is the perfect time to review your financial planning needs with a professional. End Of Year Tax Planning Checklists.

Now is the time to review and consider all of your year-end tax planning options and strategies for the 2021 tax season. Ad Excel close management checklist by accountants for accountants. If you need to make adjustments file a new W-4 at your workplace.

Heres the standard deduction amount. For 2021 the amount exempt from federal gift and estate tax is 117 million per person which means that you may give this amount during your lifetime free of gift tax with. Contact a Fidelity Advisor.

From tax filing to. However many of the corporate and international. Now is an ideal time to consider year-end tax planning strategies to potentially reduce your taxes and help you achieve your long-term.

Taking advantage of the numerous taxes can offer you to implement and. Plan now to help make April 18 20221 less taxing. 6 Year-End Tax Planning Moves for Small Business Owners to helo minimize taxes for 2021.

With the end of the year fast approaching nows the. Its time to think about year-end tax planning. Consult your tax professional.

Ad Excel close management checklist by accountants for accountants. How to close your books 3 days faster for CFOs Controllers. The personal income tax scale stage 2 tax cuts under measures set forth in 2018 were brought forward and take effect from 1 July 2020.

However plans may allow employees to submit claims within a set time run out period for. But if youre financially stable here are seven items to consider checking off your year-end financial checklist. Close your books faster.

How to close your books 3 days faster for CFOs Controllers. Max out your retirement contributions. This checklist can help you review your investment.

The maximum allowed contributions to 3600 for an individual or 7200 for a family in 2021. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. 2021 year-end tax-planning checklist.

Th2020 4 quarter estimated tax. In 2021 you can sock. Baird does not provide tax advice.

2021 Year-End Planning Checklist As 2021 draws to a close now is the time to ensure your wealth plan reflects any changes in your circumstances or goals the economic landscape and. Contact a Fidelity Advisor. 2021 Year-End Tax Planning Checklist.

If enacted in its current form the legislation would generally be effective for taxable years beginning after December 31 2021. The limit for the state and local tax deduction will increase substantially from 10000 to 80000 and this increase will apply to the 2021 tax year as well. 12550 for 2021 12950 for 2022 Head of Household.

Kickstart your tax season planning with this list of important deadlines relevant documents and strategy considerations. Close your books faster. For 2021 ARPA increases the CTC to 3600 for a child under age 6 at the close of the tax year and to 3000.

ARPA expanded the CTC by providing special rules for 2021. 18800 for 2021 19400 for 2022 Married Filing Separately. If you can swing it choose 0 allowances so you pay a larger chunk of taxes throughout the year.

Roth IRA contributions and. Kickstart your tax season planning with this list of important deadlines relevant documents and strategy considerations. Taxes are a fact of life.

While tax season 2022 may be months away New Years Eve will be here before you. Generally amounts remaining in the account at the end of the year are forfeited. Year-end is a great time to get tax planning ducks in a row and take advantage of opportunities.

2021 Year-End Tax Planning Checklist Read More. Download free checklist now. A sample checklist of items to consider for 2021 and 2022 and state charts to guide you through the Form W-2 and electronic filing requirements that apply.

With that in mind here are several things you. Year-End Tax Planning Checklist continued Robert W.

Small Business Checklist In 2022 Business Checklist Business Tax Checklist

Year End Tax Planning For Small Business Owners

2022 Q1 Marketing Checklist Marketing Checklist Marketing Plan How To Plan

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Tax Checklist

A Checklist What Documents You Need To Prepare Your Taxes

Annual Tax Planning Resources For Businesses And Individuals

Year End Tax Planning For Small Business Owners

Small Business Tax Preparation Free Checklists Fbc

Taxes Bookkeeping For Creative Entrepreneurs Bookkeeping Small Business Tips Business Tax

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

Pin On Best Of The Handy Tax Guy

How The New Tax Law Affects Your Small Business Infographic Small Business Infographic Small Business Trends Business Infographic